- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

A $10.9 Billion Reason to Buy This Dividend Stock Now

Mergers rarely cause such a stir, but Fifth Third Bancorp’s (FITB) $10.9 billion all-stock acquisition of Comerica (CMA) is landing at a turning point for the economy. This leads Well Fargo analyst Mike Mayo to give it a “Buy” rating with a $52 price target from its current price of $43.79. At the same time this deal moves forward, U.S. monetary policy and global trade rules are both shifting in ways that banks cannot ignore. The Federal Reserve has trimmed interest rates recently, taking the expected rate to 4.04% by year-end, aiming to lower borrowing costs and stimulate new lending across sectors.

Meanwhile, President Trump’s tariffs are reshaping business strategies nationwide. New duties now hit more than 60 countries, with tariff rates of 10% or higher on most affected goods. For the European Union, Japan, and South Korea, these taxes have reached 15%, and imports from places like Taiwan and Vietnam face 20% tariffs.

American companies are seeing supply chain costs climb, while nearly one-third of manufacturing firms report plans to cut hiring or move production in response to rising input prices. This collision of easier money and expensive trade makes big, forward-thinking bank deals like Fifth Third’s especially timely. The real question is, can this new scale help Fifth Third navigate an increasingly turbulent economic landscape? Let’s dive in.

Fifth Third’s Solid Financials

Fifth Third Bancorp stands out for its consistent approach to serving American families and businesses with a broad suite of financial services, including deposit accounts, lending, payments, and investment support. The dividend keeps drawing attention, with $1.60 per share giving a forward yield of 3.62%. Investors are eyeing Sept. 30 as the next ex-dividend date, with payments following on Oct. 15.

FITB stock's performance tells its own story, up 3.57% year-to-date (YTD), showing a 4.01% gain over the last year, and shares last traded at $43.79.

FITB holds a valuation of $28.98 billion. The trailing price-to-earnings (P/E) ratio comes in at 13.14, and the forward P/E ratio at 12.64, both a notch above the sector averages of 11.90 and 11.18, which signals that investors recognize Fifth Third’s dependable earnings and growth profile.

July 17 brought the latest earnings release, and the numbers gave the story some substance. This quarter, net income available to common shareholders came in at $591 million. Net interest income posted $1.495 billion, or $1.5 billion on a fully taxable equivalent basis.

For noninterest income, Fifth Third added another $750 million, broadening the revenue base. Noninterest expenses landed at $1.264 billion, keeping a lid on costs and supporting operational stability. Earnings per share, both basic and diluted, reached $0.88. Book value per share stood at $28.47, while tangible book value reached $20.98, both reflecting solid capital backing.

On the risk side, the net charge-off ratio was low at 0.45, and the nonperforming asset ratio remained at 0.72, underscoring effective credit management and discipline. Revenue momentum is clear, driven by higher loan activity and wider net interest margins.

Fifth Third’s Strategic Expansion

Fifth Third Bancorp just made the year’s biggest splash in regional banking with its $10.9 billion all-stock deal to acquire Comerica, a headline-grabbing move set to create the ninth-largest U.S. bank by assets at roughly $288 billion. Comerica shareholders will get 1.8663 Fifth Third shares for every Comerica share, valuing each at $82.88, a hefty 20% premium above Comerica’s recent average.

The deal is on track to close by the end of the first quarter of 2026 if approvals go as planned. When the dust settles, Fifth Third shareholders will hold 73% of the combined bank, with Comerica’s owners at 27%.

This merger is all about bold scale. The larger bank covers 17 of the fastest-growing markets in the country. Branches will concentrate in the booming Southeast, Texas, Arizona, and California by 2030. Management expects $850 million in cost savings annually, erasing a third of Comerica’s expense base. Two fee-driven businesses, Commercial Payments and Wealth & Asset Management, will each deliver $1 billion in recurring revenue. That’s their key for diversifying income beyond lending.

But the story doesn’t end with M&A. In July, Fifth Third teamed up with Eldridge Capital Management, a private credit powerhouse managing $70 billion. This deepens Fifth Third’s reach in asset-based and equipment finance for commercial clients and builds on earlier wins with Stonebriar Commercial Finance.

Then in September came a strategic coup as Fifth Third won the five-year contract to manage Direct Express, administering prepaid federal benefit cards to 3.4 million Americans. Most of these cardholders don’t have a traditional bank account, and 57% rely solely on government income. This contract gives Fifth Third a powerful foothold in payments.

Analysts See an Upside Worth Watching

Fifth Third Bancorp is set to release its next earnings report on Oct. 17, an event many are watching after a stretch of steady financial performance and headline-making deals. The company’s earnings outlook for the current quarter sits at $0.89 per share, up from $0.85 last year. Next quarter’s estimate rises to $1.02, compared to $0.90 a year ago.

For the full 2025 fiscal year, analysts expect $3.51 in earnings per share, higher than last year's $3.37. The forecast for fiscal 2026 jumps further to $4.05, up from the 2025 baseline of $3.51. Growth rates look healthy, with year-over-year (YoY) advances penciled in at 4.71%, 13.33%, 4.15%, and a robust 15.38% for 2026.

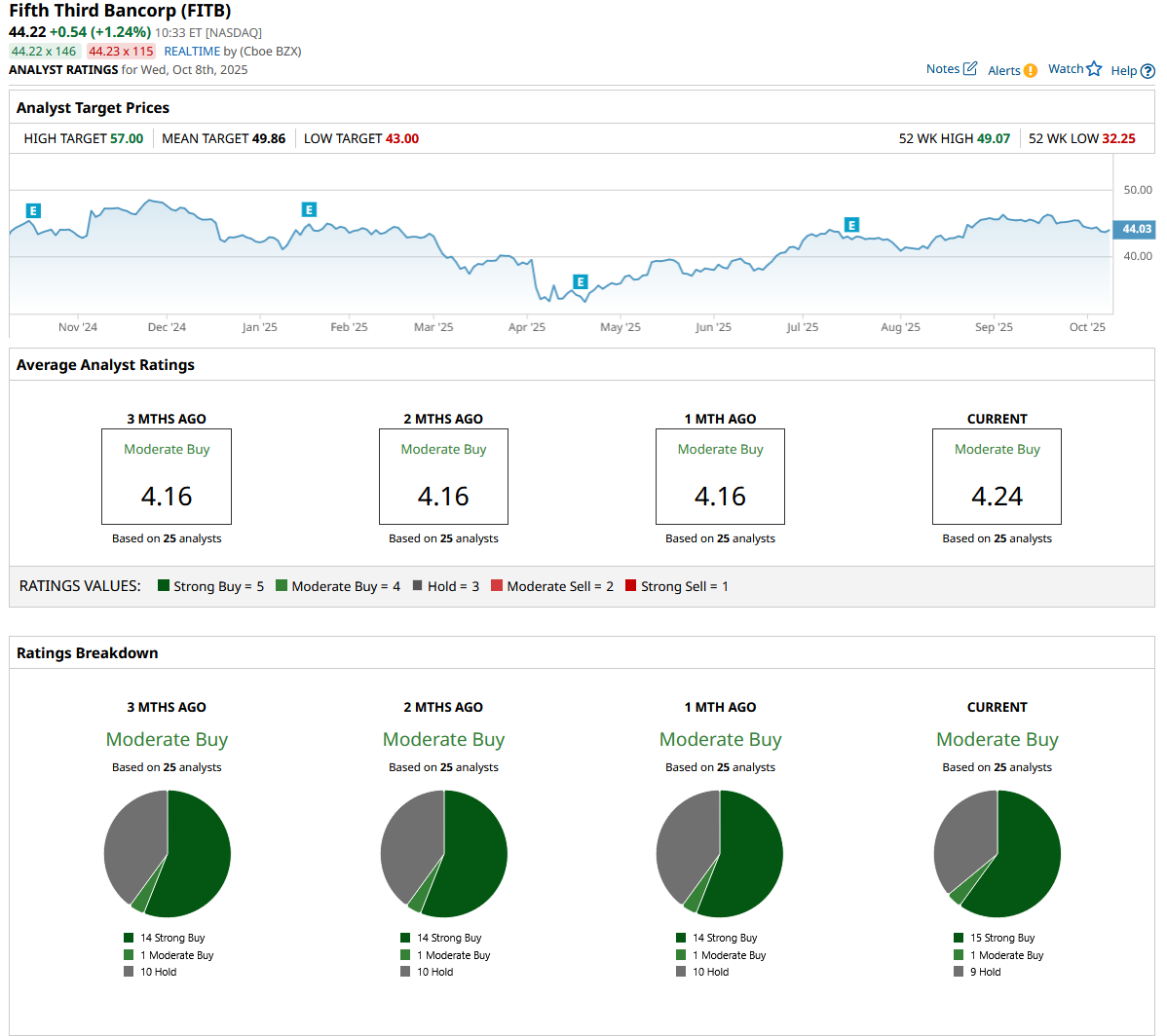

This optimism is being echoed loud and clear in consensus ratings, as 25 analysts currently covering FITB rate it a “Moderate Buy.” The average price target stands at $49.67, offering a 13.4% upside from the current price.

Fifth Third is no stranger to solid execution, but with the Comerica merger in play, the story just got a lot more interesting. A strong dividend, clear growth plans, and a healthy dose of analyst optimism stack the odds in FITB’s favor. Unless something drastic disrupts the script, shares have every reason to push higher as this new chapter unfolds.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.